Stripe Chargeback Guide: All the Rules, Time Limits & Info You Need to Know

For millions of companies around the world, Stripe is the “go-to” software for accepting online and mobile payments.

Their platform offers straightforward functionality that allows merchants of all sizes to easily make and accept payments and manage their businesses online. Unfortunately, even the most reputable online businesses can struggle with fraud and chargebacks on the Stripe platform.

Stripe has built-in features to help proactively stop fraud and offers an additional type of insurance against chargebacks. But are these enough? Let’s look at how Stripe chargebacks work, what protection the company offers, and the Stripe chargeback policy in general.

Recommended reading

- Bank of America Disputes: Here's What You Need to Know

- Wells Fargo Disputes: Chargeback Rules & Things to Know

- 10 Tips to Stop DoorDash Chargebacks Before They Happen

- American Express Chargebacks: Rules & Time Limits & More

- What is a Bank Chargeback? What Makes Them Different?

- Card-Not-Present Chargebacks: The Merchant's Guide for 2024

How Does Stripe Handle Chargebacks?

If the transaction in question was processed through Stripe, one of two things will happen when the cardholder calls the bank. Depending on the credit card brand involved, the merchant will receive either an immediate chargeback or a retrieval form.

A retrieval — sometimes called an “inquiry” or “purchase inquiry” — is basically a request for more information about the transaction. If the cardholder is legitimately questioning a transaction (as opposed to trying to commit friendly fraud), the issue can often be cleared up with additional data from the merchant. The retrieval simplifies this process.

If the issue can be resolved this way, or if the merchant chooses to pay the customer a full refund, Stripe will not charge the business a chargeback fee. If not, the dispute will be escalated into a formal chargeback.

Stripe Chargeback Time Limits

Stripe handles a lot of the process for its users. That said, a chargeback is still a chargeback. All parties are subject to the rules of the card networks, including response time limits.

After the chargeback is initiated, the merchant will usually have between 7 and 21 days to respond with evidence. The exact time frame will vary based on factors such as the reason code or the card network. Missing the deadline means the cardholder automatically wins the dispute and keeps the funds.

The cardholder’s bank has a limited window in which to respond, usually 60-75 days. Again, the exact time frame will vary based on the card network.

Learn more about chargeback time limitsStripe Chargeback Fees

Like other banks and processors, Stripe charges an administrative fee for each chargeback the merchant receives. While Stripe will waive the chargeback fee if the case is withdrawn or resolved prior to a formal chargeback filing, this $15 fee generally applies even if the chargeback is deemed invalid.

The fee amount can vary by region, product vertical, and other factors. For businesses in the Single Euro Payments Area (SEPA), for example, cards processed on the Cartes Bancaires network will incur no dispute fee.

The Stripe chargeback fee is not intended to be punitive. Rather, it’s a way for the company to recoup some of the costs of dealing with the chargeback. Unfortunately, this fee is only one small part of the cost of chargebacks.

Beyond Stripe’s chargeback fee, there are other potential fees or fines from banks and the card networks. The merchant will also lose both the merchandise and the revenue from the original transaction, plus any ancillary expenses such as shipping and inventory. This doesn’t include the time and effort spent collecting and submitting evidence. Even for a low number of chargebacks, the costs can add up quickly.

Learn more about Stripe chargeback feesStripe assesses a $15 fee per each chargeback received in the US market. However, this fee may vary depending on the region or the currency involved. You can contact Stripe’s sales and support team for details on specific costs from the company’s pricing page.

Stripe Account Reserves

Stripe monitors each merchant’s account, evaluating payment activity, chargeback rates, and other factors. If a business shows a higher risk of customer refunds or disputes, Stripe may require an account reserve for that merchant.

An account reserve is a set percentage deducted from each transaction processed on the account. These funds are held in reserve to help ensure the merchant has funds on hand to cover future refunds or disputes.

Let’s look at an example. Assume we have a US merchant with a 25% reserve, a fixed release window of 30 days, and standard two-business day payout timing:

Having a Stripe reserve account does not impact the merchant’s ability to accept payments, and the company will continue to monitor the account to remove or decrease the reserve. It does mean that a portion of your revenue is permanently inaccessible, though, as long as the reserve is in place.

Learn about merchant account reservesStripe Radar & Chargeback Protection

Stripe Radar is a machine-learning program that uses adaptive algorithms to help detect and block fraud. The system pulls data from a wide range of sources. It evaluates each payment’s risk level in real-time.

One optional element of Radar is Stripe Chargeback Protection. Stripe will cover the cost of eligible chargebacks and waive the Stripe chargeback fee for merchants enrolled in the program. The company only requires the merchant’s account to be in good standing.

Naturally, there is a charge for this protection, though. Stripe Chargeback Protection costs 0.40% of the transaction total per transaction. This is in addition to the standard rate for transaction processing.

If a transaction costs $100, a merchant will pay $3.60 to process that transaction with Chargeback Protection. The higher rate will apply to all successful transactions, and several common types of chargebacks aren’t covered. Merchants need to check carefully to ensure the program is cost-effective for their business before opting in.

Learn about Stripe Chargeback ProtectionResponding to Chargebacks Using the Stripe Dashboard

Responding to Stripe chargebacks is a straightforward process designed to give merchants a fair chance to dispute unauthorized transactions or misunderstandings with customers. Here's how to handle chargebacks using the Stripe dashboard:

Step #1 | Notification

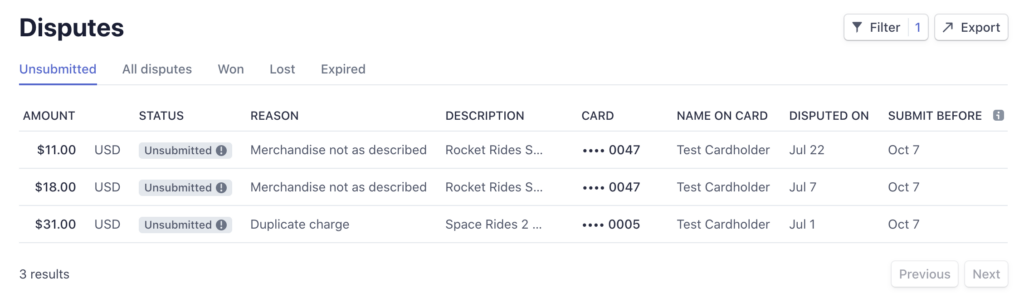

Stripe will notify you via email and through the dashboard if a customer disputes a charge, initiating a chargeback. The dispute will also be visible in the “Disputes” section of your Stripe dashboard.

Step #2 | Review Dispute Details

Before responding, review the dispute details carefully. Stripe provides information about the reason for the dispute, the amount, and the deadline for your response. Understanding the reason for the chargeback (such as unauthorized transaction, product not received, or product not as described) will help you gather the appropriate evidence.

Step #3 | Gather Evidence

Collect all relevant evidence to support your case. Any other documents that prove the transaction was valid and the product or service was provided as described may apply. Examples of compelling evidence may include proof of delivery or service completion (such as tracking numbers or signed confirmation), or a copy of the terms of service or return policy that the customer agreed to. Communication records between you and the customer that demonstrate the dispute is unjustified may help, too.

Step #4 | Submit Your Evidence

Once you've gathered your evidence, submit it through the Stripe dashboard. To do this, go to the “Disputes” section of your dashboard. Select the dispute you wish to respond to, then click on "Submit evidence." Follow the instructions to upload your documentation and provide any additional comments or explanations that could support your case.

Step #5 | Wait for Resolution

After you submit your evidence, the customer's bank will review the information provided by both parties and make a decision. The resolution process can take anywhere from a few days to a few months, depending on the complexity of the dispute and the bank's processes.

Step #6 | Outcome Notification

Stripe will notify you of the outcome. If the dispute is found in your favor, the disputed amount and any fees charged will be returned to you. If the dispute is upheld in favor of the customer, the chargeback amount will be permanently removed from your account.

Keep in mind that responding to chargebacks effectively requires timely action and clear, comprehensive evidence to support your case. The Stripe dashboard facilitates this process, allowing merchants to manage disputes directly within the platform. However, this still does not guarantee success.

How to Prevent Stripe Chargebacks

Fighting chargebacks is an important part of a comprehensive management strategy. Still, it’s best to prevent as many Stripe chargebacks as possible. Here are a few suggestions to prevent chargebacks on your Stripe account:

#1 | Clear Communication

Make sure that your business name, contact information, and customer service details are clearly visible and recognizable on your website and at checkout. This helps customers recognize transactions on their statements, reducing confusion and accidental chargebacks.

#2 | Transparent Policies

Clearly state your return, refund, and cancellation policies on your website. Make sure these policies are easy to find and understand and that customers acknowledge them during the checkout process.

#3 | Detailed Product Descriptions

Provide detailed and accurate descriptions of products or services, including high-quality images or videos. Setting the right expectations can reduce disputes related to product or service dissatisfaction.

#4 | Prompt Customer Service

Offer responsive and helpful customer service. Quick and effective resolution of customer concerns or complaints can prevent chargebacks. Provide multiple channels for customer support, such as email, phone, and live chat.

#5 | Send Confirmation Emails

For each transaction, send a confirmation email that includes the transaction details, such as what was purchased, the amount paid, and the expected delivery date. This reinforces the purchase details and provides an easy way for customers to raise any immediate concerns.

#6 | Use Fraud Detection Tools

Take advantage of Stripe's fraud detection and prevention tools, such as Stripe Radar, which uses machine learning algorithms to help identify and block fraudulent transactions before they result in chargebacks.

#7 | Implement Strong Customer Authentication

Use strong customer authentication methods, like 3-D Secure, which adds an additional layer of security by requiring customers to complete an additional verification step with their card issuer when paying.

#8 | Monitor High-Risk Transactions

Pay special attention to orders that seem out of the ordinary, such as those with very high values or orders shipped to countries where you don't typically do business. Reach out to customers for additional verification if something seems off.

#9 | Educate Your Team

Make sure your team is knowledgeable about chargeback prevention strategies, how to detect potential fraud, and how to apply best practices for customer service.

#10 | Analyze Chargeback Patterns

Regularly review chargebacks and disputes to identify patterns or common issues. Understanding why chargebacks are happening can help you make necessary adjustments to your product offerings, policies, or customer service practices.

Implementing these strategies requires a commitment to excellence and an understanding of customers’ needs and expectations. Remember, preventing chargebacks before they happen not only protects your revenue but also strengthens your brand's reputation, leading to a more successful and sustainable business.

Stripe Chargebacks: The Bottom Line

While there are differences, Stripe chargebacks offer most of the same challenges as any other dispute. Management can be difficult and time-consuming. Not only is the subject complicated, it’s also slightly different for each entity involved. Just getting started requires a serious investment of resources.

Fraud is constantly evolving, and so are the laws and requirements for fighting it. The landscape is always in flux, meaning trends and techniques must be updated regularly.

Unfortunately, chargeback self-management strategies have a low success rate, statistically speaking. In other words, managing chargebacks without help involves massive amounts of work…but offers little chance of success.

It can be tempting just to give up and accept chargebacks as a cost of doing business, but there’s a better way. Chargebacks911® offers the most comprehensive chargeback analysis and management strategies available today. Our customized solutions can take chargebacks entirely off your plate and increase your ROI. To learn more, contact us today.

FAQs

Can you do chargeback on Stripe?

Yes, you can initiate a chargeback on Stripe by disputing a charge with your bank or credit card issuer, which Stripe then facilitates between the bank and the merchant. The process is designed to resolve disputes over unauthorized transactions or issues with the purchased product or service.

How much does Stripe charge for chargebacks?

Generally, Stripe charges a $15 fee for chargebacks in the United States. The fee may vary by country.

What is the difference between a chargeback and a refund on Stripe?

A refund on Stripe is initiated by the merchant to return funds to a customer, typically due to a return or a service issue, and is a direct transaction between the merchant and the customer. A chargeback, on the other hand, is initiated by the customer through their bank or card issuer against a transaction, often due to disputes over unauthorized charges or dissatisfaction with goods or services, and involves a formal dispute process that Stripe facilitates between all parties involved.

How long does a chargeback take on Stripe?

After the chargeback is initiated, the merchant will usually have between 7 and 21 days to respond with evidence. The exact time frame will vary based on factors such as the reason code or the card network. Click here to learn more about chargeback time limits.

How many chargebacks are you allowed?

Stripe doesn’t set a specific limit on the number of chargebacks you can have. However, most card networks set a chargeback threshold of 1% of transactions (or less), which makes maintaining a low chargeback rate very important. If the chargeback rate becomes excessively high or poses a risk, it could lead to account review, additional fees, or even account closure, as Stripe aims to minimize financial risk and maintain compliance with card network regulations.